From back-office tasks to handling customers, virtual assistants, a.k.a., chatbots are innovating the Insurance sector by leaps and bounds. And understandably so. The new-age policy-holder is also transforming. From shopping for – and even self-servicing aspects of – insurance policies online to comparing policy quotes and prices, customers have evolved, and so have their expectations from the insurers. In fact, data by Cognizant claims that 64% of users say that the best insurance chatbot feature is the ability to contact customer service 24 hours a day.

In this blog, we will look at the top-4 use cases of insurance chatbots that are enhancing customer experience, while winning their hearts and minds – one conversation at a time:

1. Quick Access to Information: For the Policyholder & the Provider

In the insurance world, the value of getting contextually-relevant and insight-driven customer data for insurers cannot be overstated. On the other hand, there’s a growing need to educate customers about the existing products and services. This is where chatbots work their charm. Let’s look at some real-life examples to understand how this process works:

HDFC’s life insurance chatbot, Elle, is a good example to start with. This chatbot doubles up as a Financial Guide to assist users in choosing the best plans and solutions for them. The bot is available 24×7 for users and is capable of addressing routine FAQs in addition to answering queries related to policy details, requests for premium receipts, fund value, payment history, annual premium statement, among other things.

“Elle is another initiative by HDFC Life to simplify customer interactions and provide a quick and easy resolution to their queries, from anywhere and at any time.” – Subrat Mohanty, Chief Operating Officer at HDFC Life

Another interesting example to consider is VisitorCoverage’s travel insurance intelligent chatbot, Luna, which sells contextual travel insurance policies to frequent travelers. This bot leverages AI and machine learning capabilities to help customers navigate the complexities of travel insurance while delivering top-notch services, and that too, regardless of the user’s location and time difference:

Key takeaway: Virtual chatbots are bridging the gap between the policyholder and the provider to offer a seamless customer service that’s in everyone’s best interests.

2. Automated Insurance Agents, at the Customer’s Beck-and-Call

Contrary to popular opinion, chatbots, in general, have evolved over time to be able to handle complex procedures such as claims filing, goal setting, etc. in a jiffy. One of the catalysts of this change can be attributed to the fact that these smart bots have gone from being reactive to proactive – in delivery, and in style.

This is precisely why 53% of people are more likely to buy a product from a provider they can reach out to on a chat app.

In fact, it wouldn’t be out of line to imagine these bots as every customer’s personal insurance agent. After all, chatbots can address queries throughout the insurance value chain and offer a host of other personalized benefits such as:

- 24×7 customer service.

- Reduced processing time.

- Instant query resolution (thanks to a rich database).

- Streamlined and simplified customer service.

- Patient access to relevant information and reminders (e.g., for pending payments) at every step of the way.

The end-goal? By digitizing the Insurance customer journey, these mobile-enabled bots have been able to boost customer satisfaction in the insurance realm.

Zurich UK’s bot, Zara, is an interesting case in point. The bot enables users to process claims relating to non-emergency car and home claims in an effortless manner:

The bot initially gathered data pertaining to the customer’s preferences and sentiments based on various metrics such as adoption, customer satisfaction, etc. to gauge the consumer’s perception. The results were anything but ordinary. An article from the Business Insider quotes:

“The insurer beat expectations in terms of the number of reported claims through Zara. It also recorded a transactional Net Promoter Score, a customer satisfaction metric, of 80 — which constitutes a “world-class” rating — and slashed the time it takes to process claims.”

Key takeaway: By providing an “always-on” digital experience around claims, the company was able to deliver a compelling customer experience.

3. Guided Buyer Experience for an Individualized CX

“Insurers could save up to $7 billion over 18 months using AI-driven technologies by streamlining administrative processes.” – Accenture Report

In the healthcare technology and insurance domains, chatbots have been assisting users on a variety of complex tasks such as providing information addressing billing inquiries, explaining the pre-authorization processes, guiding users in the claims filing process, checking the claims status, understanding the existing coverage, and so on and so forth.

Take, for instance, the case of Zhong An – China’s online-only insurance company, which boasts more than 400 million customers with over 10 billion policies sold! But what attributed to the company’s gigantic success? The answer lies in using AI-driven data to extract behavioral data from more than 300 partnerships. This helps the company cash in at the right moments in which the customer can use an insurance product.

“Insurance is a data game. In the future, IoT, everything within telematics, and even wearables will generate huge piles of data. The question is if you use this data to really generate tailor-made solutions for your new customers. The second time your customer buys the same policy, maybe you could consider different scenarios for pricing. To understand and use your customer’s latest data for recent purchases; that would be the preferred direction.”—Bill Song

The company claims that over 97% of the customer queries are directed to its chatbot communication tool, not requiring any human intervention. As you can imagine, this not only lowers staff load but also drives a quality-driven interaction with users and offers them instant gratification – both of which are key for delivering a holistic patient experience.

Other chatbots that deserve a special mention include:

- Commercial auto insurer, Next Insurance’s bot on Facebook Messenger

with which small businesses can obtain quotes and buy insurance:

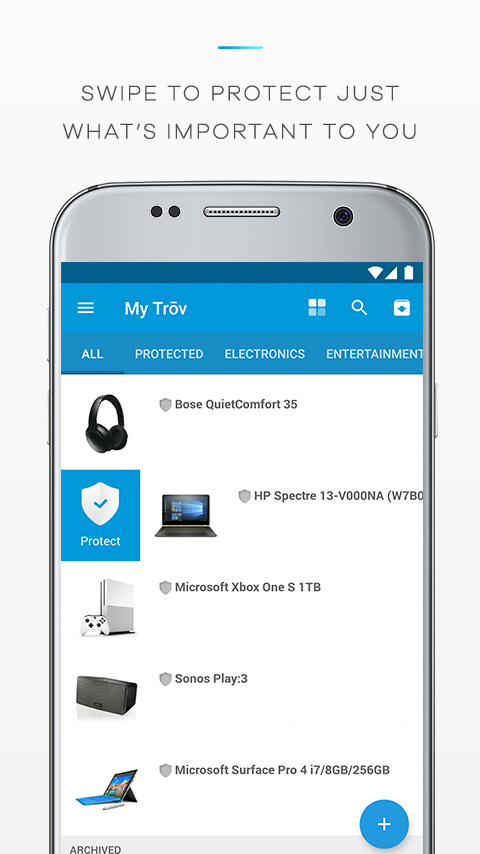

- Trōv’s bot offers on-demand insurance covering personal items such as electronic gadgets, home appliances, etc.:

Key takeaway: In the Insurance domains, chatbots will soon emerge as the rule, not the exception. And why not? More and more chatbots are emerging as the patient’s personal assistant for all things insurance- and healthcare-related, making their lives convenient as they recover from their ailments.

4. Faster & Efficient Claims Management & Underwriting Processes

“The global chatbot market is expected to reach USD 1.25 billion by 2025, growing at a CAGR of 24.3%.” – Cognizant Study

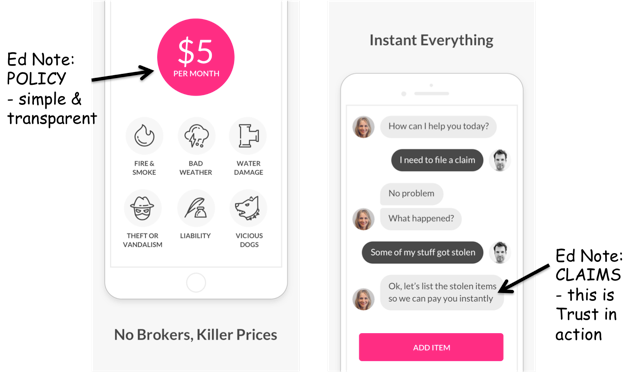

If you think conducting insurance business only requires human agents, think again. Lemonade Insurance’s business is conducted online, solely by their in-house chatbot Maya. In fact, the company has been able to drive conversations with users that mirror those with live agents. A remarkable feat, in our opinion:

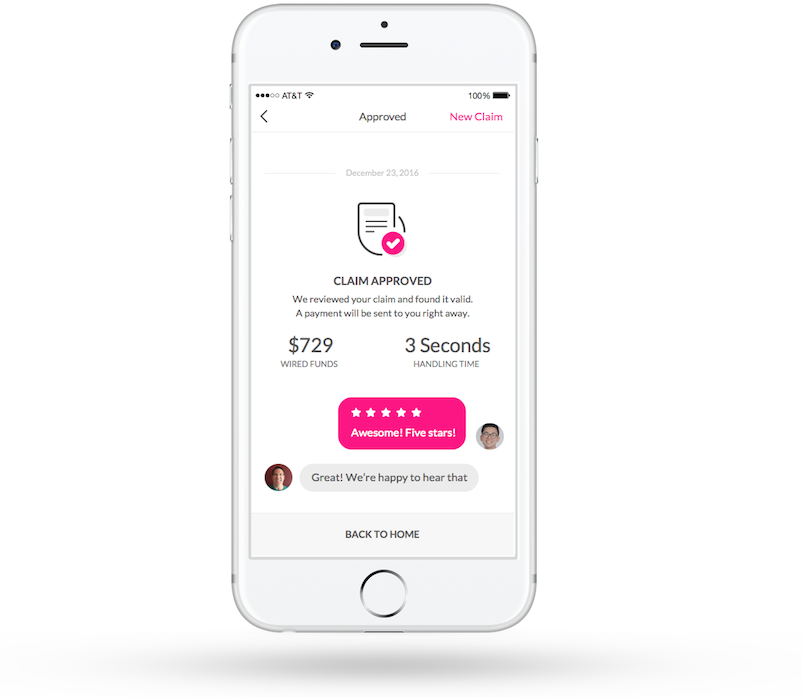

That’s not all. Lemonade Insurance’s AI bot, Jim, set a new world record by paying the insurer’s claims in just three seconds and with zero paperwork (sounds too good to be true right?). Here’s the proof:

Key takeaway: Insurance chatbots can seamlessly integrate communication, comprehension, and collaboration, keeping customer-centricity in mind at all times – ultimately boosting customer satisfaction and happiness.

Closing Thoughts

“68% of insurers are already using chatbots in various segments of their business.” – Accenture

Clearly, chatbots and other AI-driven technology have evolved from being mere instruments of Insurance sales pitches to virtual conversational agents that have transcended the overall customer experience to another level by facilitating multi-faceted customer interactions. What’s your (s)take?